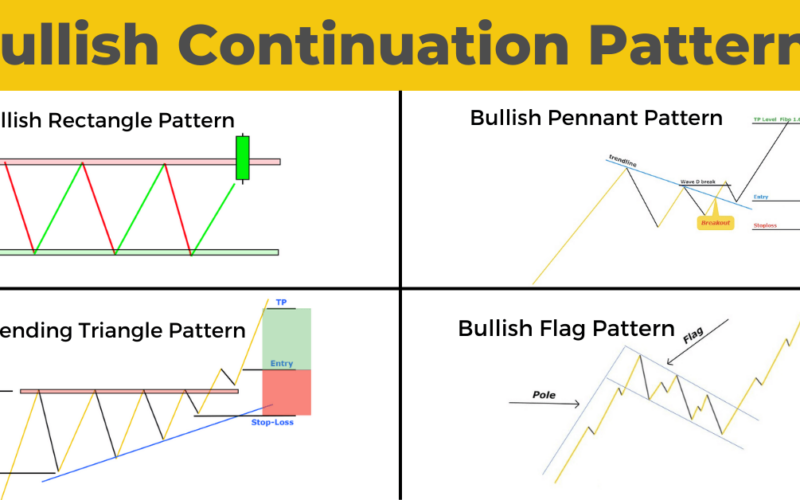

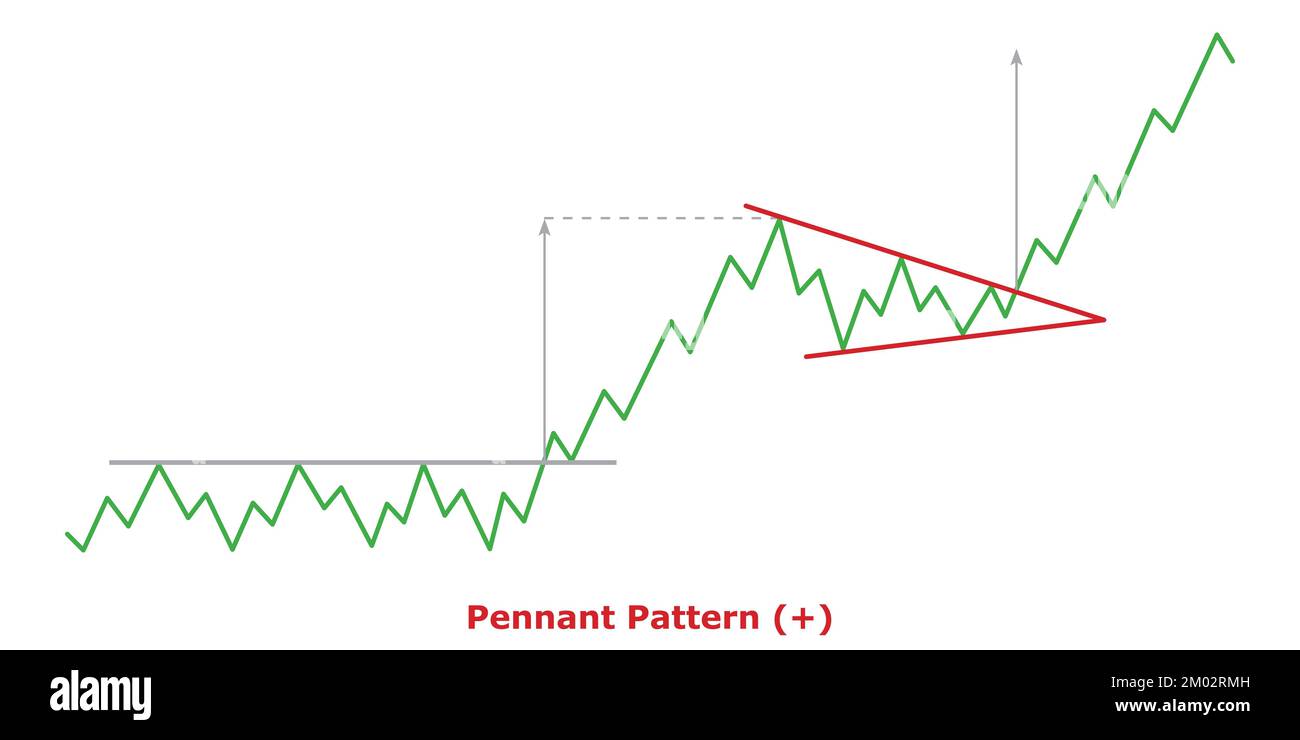

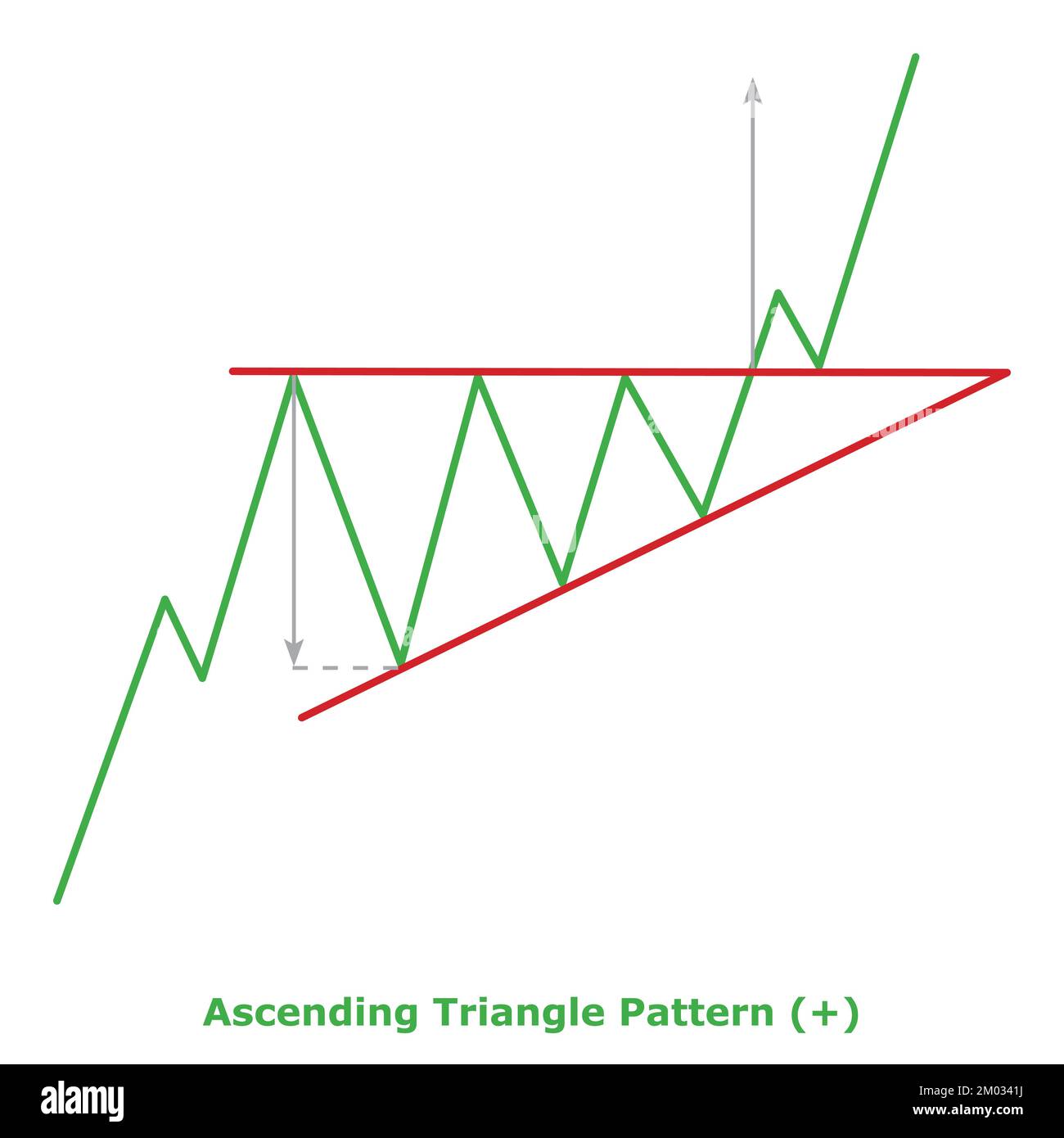

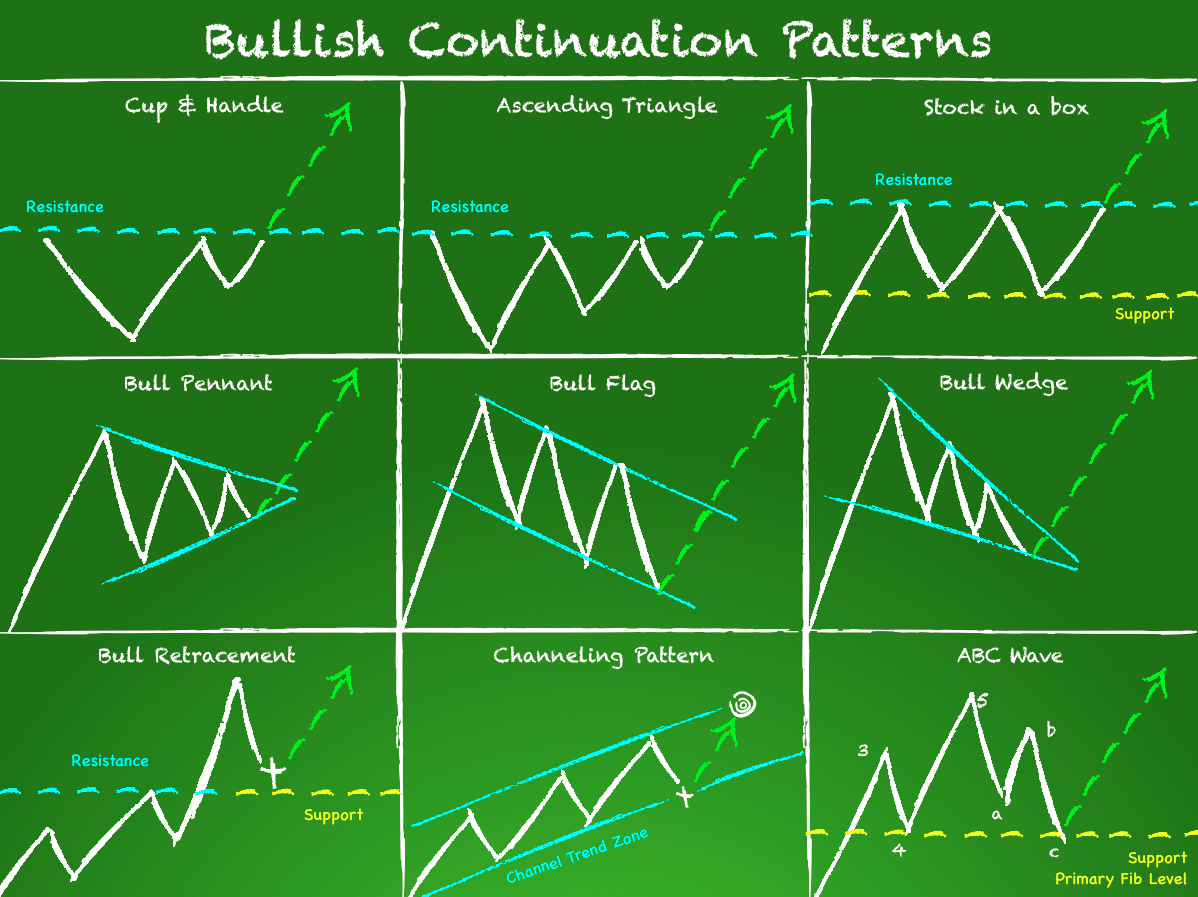

Bullish Continuation Pattern

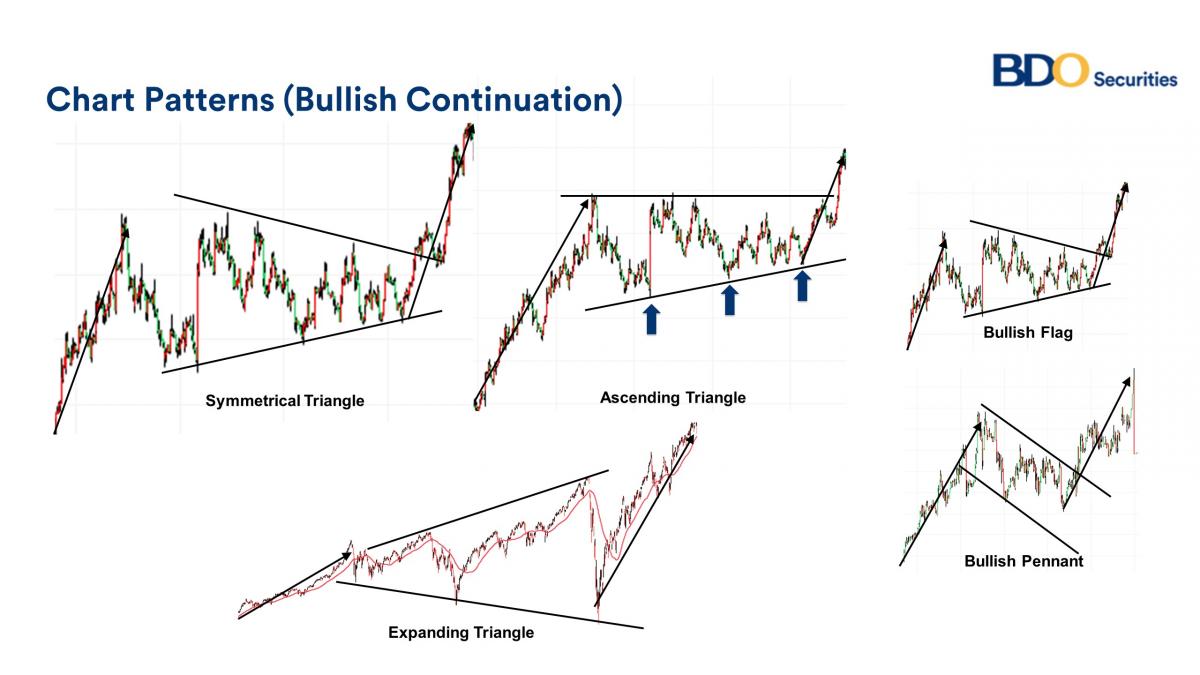

Bullish Continuation Pattern - Web you’ve learnt about the characteristics, significance, and the trading psychology behind these 5 bullish continuation patterns: Their appearance within a downtrend gives different signals (see the relevant section of this guide). Web bullish continuation candlestick patterns are specific formations that suggest the continuation of an ongoing bullish trend. Body to wick ratio of candles for rally base rally pattern. This can occur where an upward trend has paused and become stable, followed by an upswing of a similar size to the prior decline. Eur/cad could reach 1.5000 and beyond if it continues bullish momentum. The doge price needs a flag pattern breakout to escape the ongoing correction trend. Most bullish reversal patterns require bullish confirmation. Web japanese candlestick continuation patterns are displayed below from strongest to weakest. After small reversals or pauses price continues it’s direction. Initial rally is basically a sharp move toward buy side after that a period of consolidation in the base phase and finally a second rally after breakout of the base, shows continuation of previous bullish move. The doge price needs a flag pattern breakout to escape the ongoing correction trend. Eur/cad could reach 1.5000 and beyond if it. According to crypto analyst ali martinez, solana might be eyeing the $1,000 price mark given a bullish pattern formation on its chart. Continuations tend to resolve in the same direction as the prevailing trend: The ascending triangle is a bullish pattern and is plotted by two trendlines (upper and lower). Web go to tradingview and click indicators > technicals > patterns. Price doesn’t move in a single direction, it always takes a small reversal or pauses. Web bullish continuation candlestick patterns are specific formations that suggest the continuation of an ongoing bullish trend. These patterns are recognizable chart formations that signal a temporary period of consolidation before the price continues to move in the same direction as the original trend. Web eur/cad is tipped to go higher if a bullish continuation pattern completes. When the price of a security rises, it is said that it’s a bullish movement. The decisive (fifth) strongly bullish candle. Web go to tradingview and click indicators > technicals > patterns. Web bullish and bearish continuation patterns. Scanning for bullish chart patterns. It develops during a period of brief consolidation, before. These patterns occur during periods of price consolidation, generally following a strong uptrend in a financial instrument, such as a stock or currency pair. Web what are bullish continuation chart patterns? Most bullish reversal patterns require bullish confirmation. This classic bullish pattern suggests a continuation of the upward trend. In a triangle pattern, the price forms several highs and lows before converging into a triangle. In his recent tweet, ali presents a solana price chart, highlighting the formation of the bull pennant. Web what is a bullish continuation pattern? Web you’ve learnt about the characteristics, significance, and the. The continuation patterns below have a specific meaning within a bull market or uptrend; Web go to tradingview and click indicators > technicals > patterns. Web a bullish continuation pattern is a chart pattern used by technical analysts that indicates a pause or consolidation in an uptrend before the market continues its upward movement. Web bullish continuation pattern and macd. Web continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. These patterns provide insights into the market sentiment and the potential strength of the buyers. Web bullish continuation pattern and macd crossover signal potential rise to $0.174. Web go to tradingview and click indicators > technicals > patterns. Pennants,. It should be noted that a. According to crypto analyst ali martinez, solana might be eyeing the $1,000 price mark given a bullish pattern formation on its chart. The continuation patterns below have a specific meaning within a bull market or uptrend; The ascending triangle is a bullish pattern and is plotted by two trendlines (upper and lower). Get automatic. Web you’ve learnt about the characteristics, significance, and the trading psychology behind these 5 bullish continuation patterns: Web bullish continuation patterns. These patterns occur during periods of price consolidation, generally following a strong uptrend in a financial instrument, such as a stock or currency pair. Web eur/cad is tipped to go higher if a bullish continuation pattern completes. Automatic pattern. The ascending triangle is a bullish pattern and is plotted by two trendlines (upper and lower). Web bullish continuation patterns are key indicators that traders and investors use to identify the likelihood of a trend persisting. Get automatic pattern recognition free with tradingview. Web bullish and bearish continuation patterns. This pattern indicates strong buying. Most bullish reversal patterns require bullish confirmation. In his recent tweet, ali presents a solana price chart, highlighting the formation of the bull pennant. The price pattern is enhanced by the adx indicator rising strongly above 20. Continuations tend to resolve in the same direction as the prevailing trend: The doge price needs a flag pattern breakout to escape the. The price pattern is enhanced by the adx indicator rising strongly above 20. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. Web eur/cad is tipped to go higher if a bullish continuation pattern completes. Web otherwise, it’s not a. Eur/cad could reach 1.5000 and beyond if it continues bullish momentum. Web eur/cad is tipped to go higher if a bullish continuation pattern completes. Web bullish continuation patterns. This classic bullish pattern suggests a continuation of the upward trend. The price pattern is enhanced by the adx indicator rising strongly above 20. It should be noted that a. Price doesn’t move in a single direction, it always takes a small reversal or pauses. Some of the major ones to look out for. It develops during a period of brief consolidation, before. Get automatic pattern recognition free with tradingview. Most bullish reversal patterns require bullish confirmation. This can occur where an upward trend has paused and become stable, followed by an upswing of a similar size to the prior decline. When the price of a security rises, it is said that it’s a bullish movement. If the market conditions are set in stone for further growth, and most market participants feel confident enough about it, these trends may help traders to enter/exit the market for maximum profits while keeping the. These patterns are recognizable chart formations that signal a temporary period of consolidation before the price continues to move in the same direction as the original trend. Automatic pattern recognition with tradingview.Bullish Continuation Patterns Overview ForexBee

Bullish Continuation Chart Patterns And How To Trade Them? Equitient

Flag Bullish Continuation Pattern ChartPatterns Stock Market Forex

Pennant Pattern Bullish (+) Green & Red Bullish Continuation

Ascending Triangle Pattern Bullish (+) Small Illustration Green

Bullish Continuation Chart Patterns And How To Trade Them? Equitient

Top Continuation Patterns Every Trader Should Know

Top Continuation Patterns Every Trader Should Know

Are Chart Patterns Reliable? Tackle Trading

Continuation Patterns

Web What Are Bullish Continuation Chart Patterns?

These Small Reversals And Pauses Makes Patterns.

Web A Bullish Continuation Pattern Is A Pattern That Signals The Upward Trend Will Continue In A Bullish Direction After A Price Breakout And A Bearish Continuation Pattern Is A Pattern That Signals The Downward Trend Will Continue In A Bearish Direction After A Price Breakdown.

Bullish Trend Patterns Are Charts/Graphs Representing An Upward Trend In The Market.

Related Post: