Hammer Chart Pattern

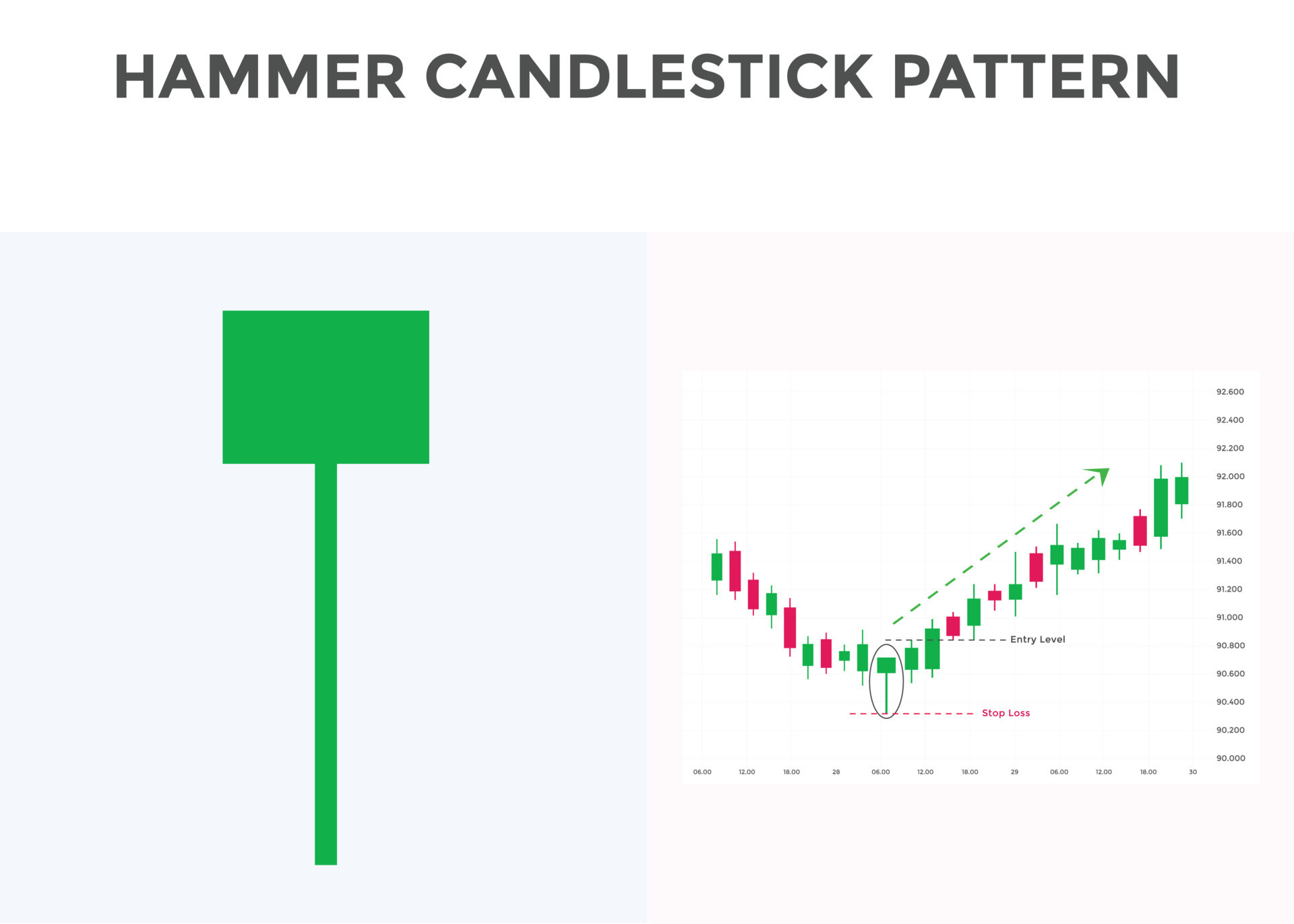

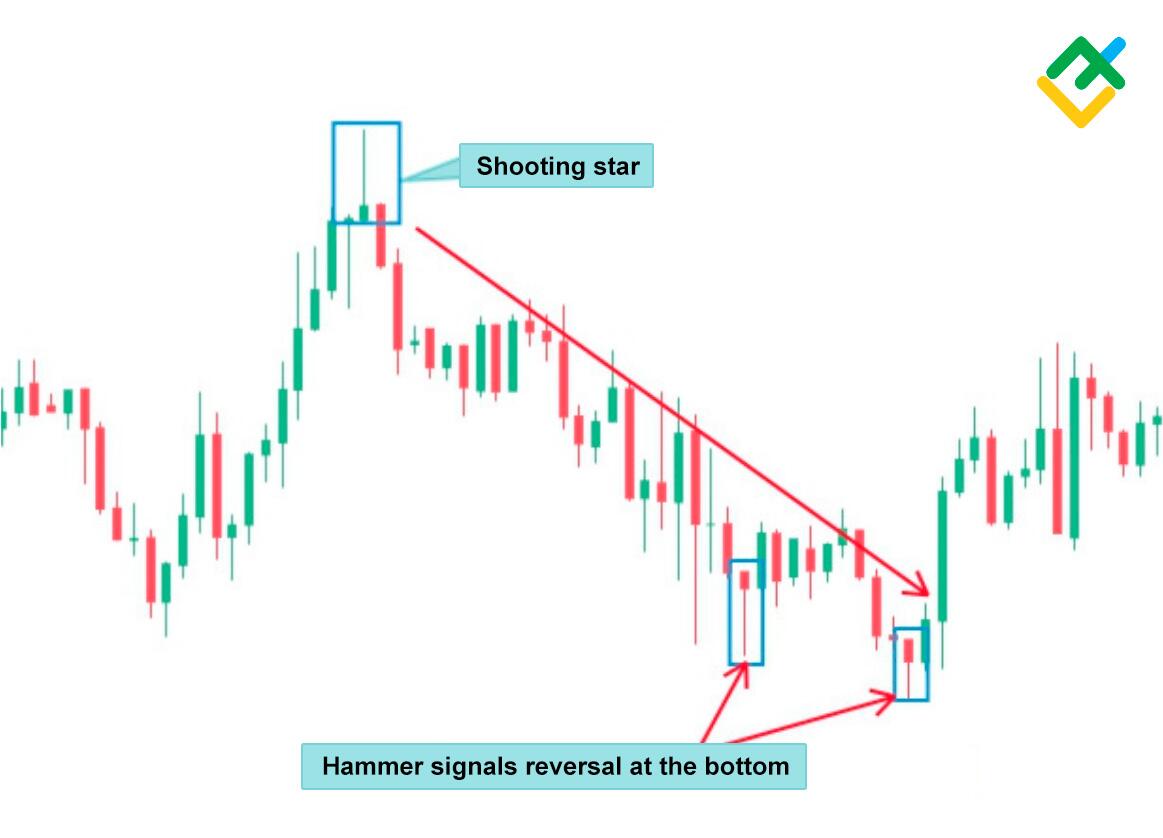

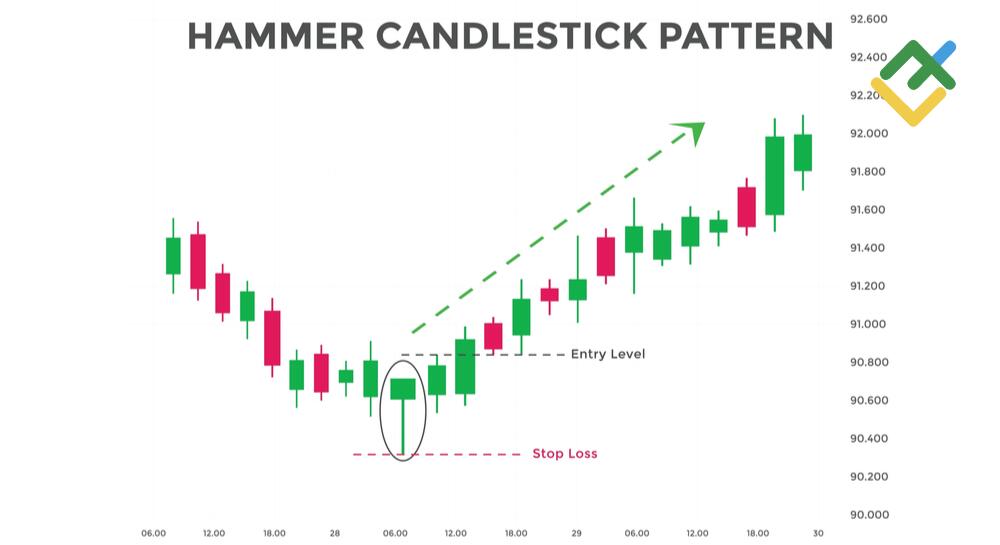

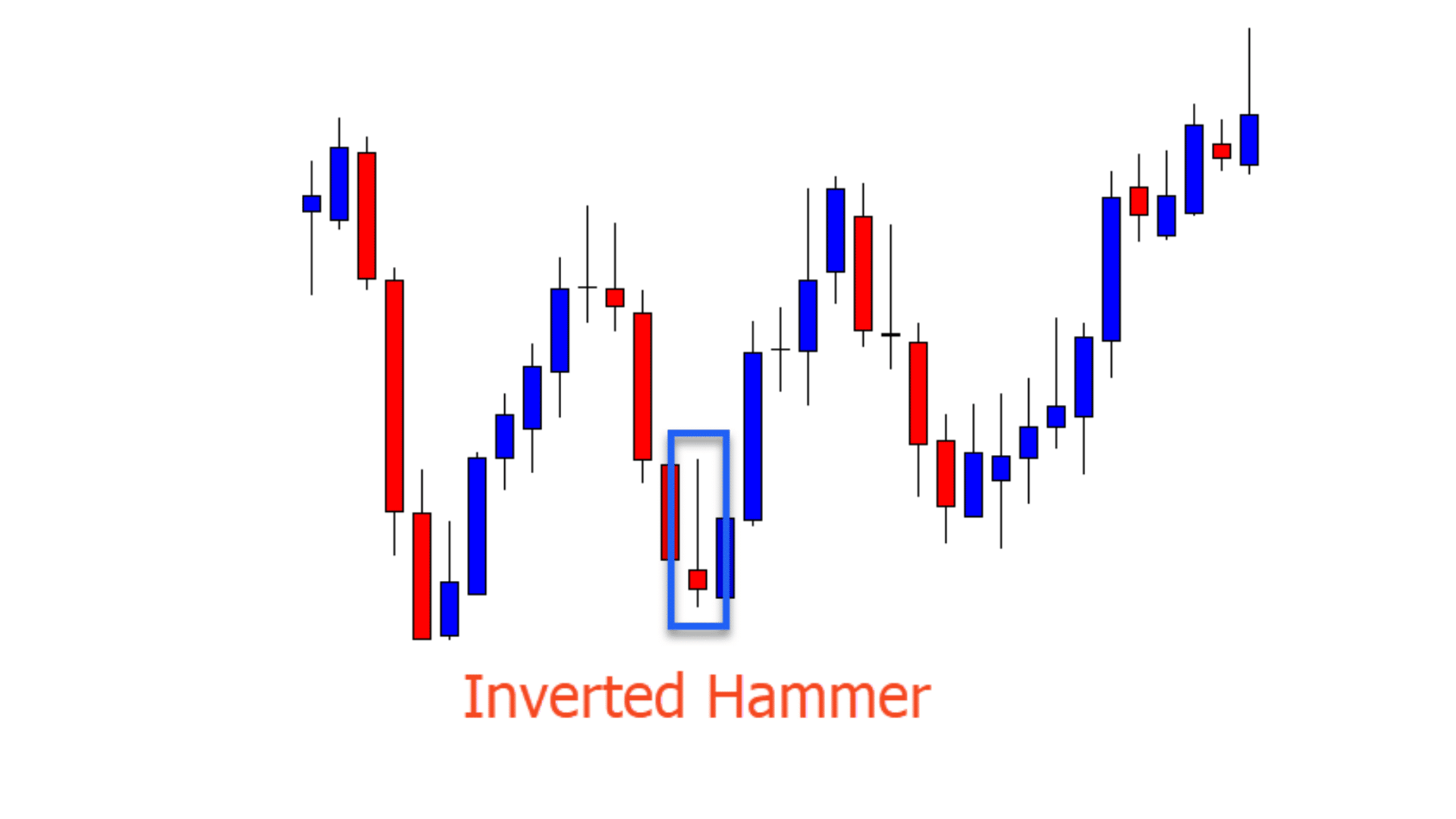

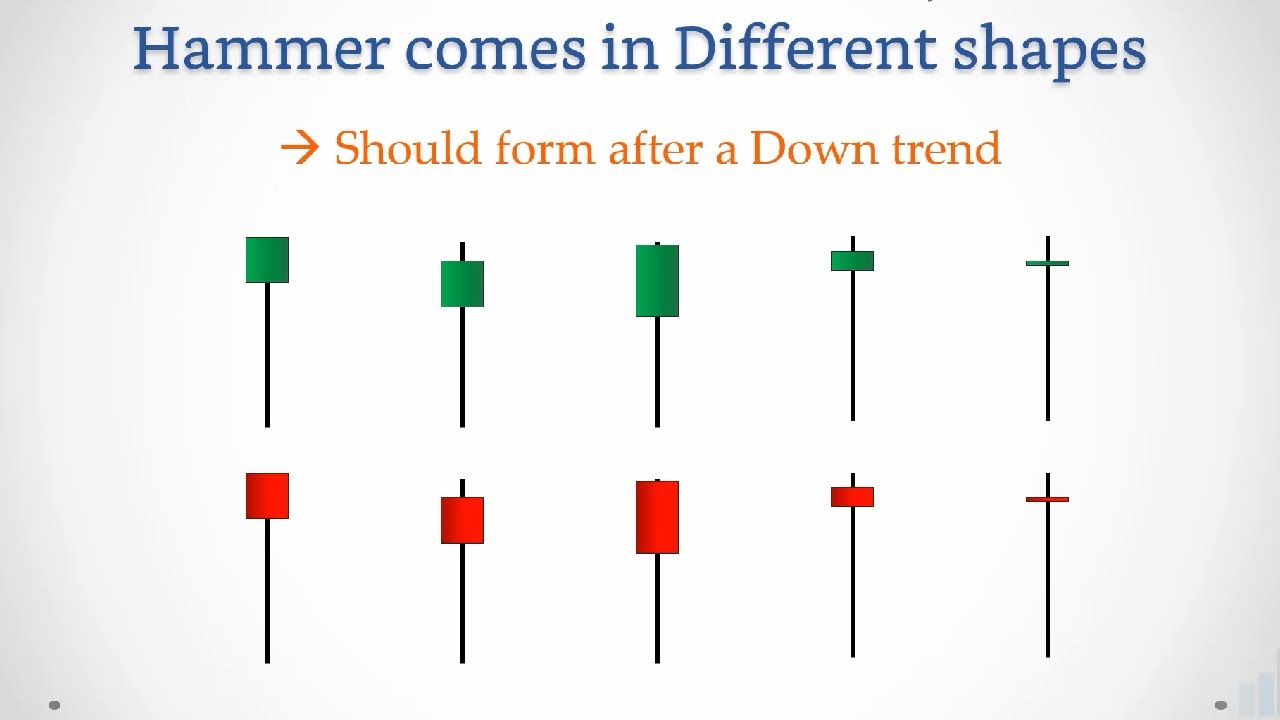

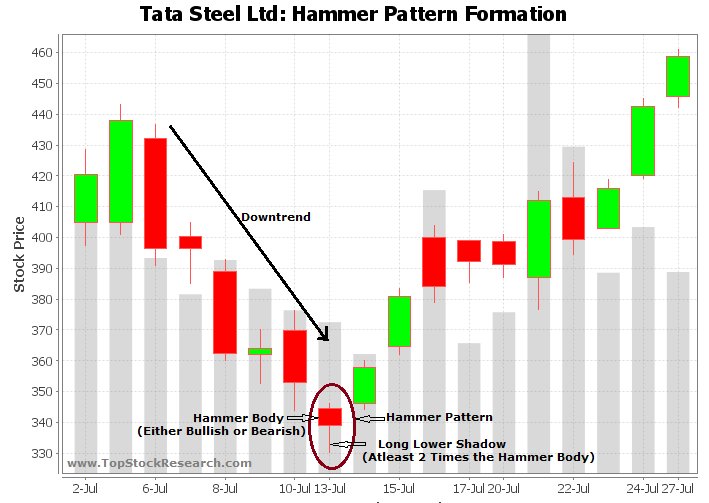

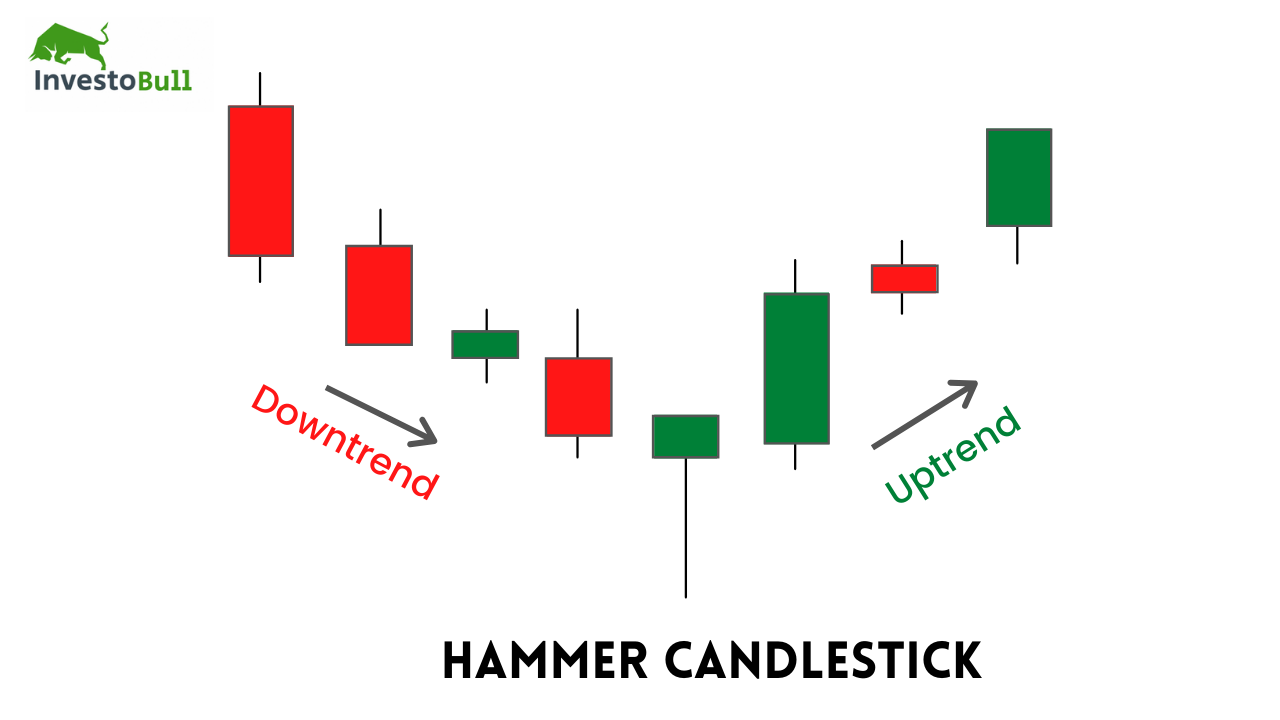

Hammer Chart Pattern - The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. How to trade a hammer? Chart prepared by david song, strategist; Web what does hammer candlestick pattern tell you? And, what is an inverted hammer? While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last trading session. Web the first important thing is that jasmy token formed a hammer chart pattern whose lower side was at $0.0193. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. Web a downtrend has been apparent in reddit inc. It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. How to trade a hammer? We will dissect the hammer candle in great detail, and provide some practical tips for applying it in the forex market. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. A downtrend has been apparent in reddit inc. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. Web the first important thing is that jasmy token formed a hammer chart pattern whose lower side was at $0.0193. This article illustrates these patterns in this order: Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. This article illustrates these patterns in this order: Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web the first important thing is that jasmy token formed a hammer chart pattern whose lower side was at $0.0193. Web the hammer candlestick pattern is a technical analysis tool. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. There are two types of hammers: Web this pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. The. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was. The formation of a hammer. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Learn to identify trend reversals with candlestick in 2 hours by market experts. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. The hammer candle typically appears. Can a bullish hammer be red? Web a hammer candle is a popular pattern in chart technical analysis. We will dissect the hammer candle in great detail, and provide some practical tips for applying it in the forex market. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. The information. Web the above chart shows what a hammer candlestick pattern looks like. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last trading. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. The formation of a hammer. The information below will help you identify this pattern on the charts and predict further price dynamics. Web what is a hammer candlestick pattern? This pattern appears like a hammer, hence its name: The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. The candles show a price decline followed by the hammer formation shadow being more than double in length compared to the hammer body. Web. It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. Is the hammer bullish or bearish? Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. How to trade a hammer? You will improve your candlestick analysis skills and be able to apply them in trading. We will dissect the hammer candle in great detail, and provide some practical tips for applying it in the forex market. And, what is an inverted hammer? If the candlestick is green or. What is the hammer candlestick after an uptrend? Web the first important thing is that jasmy token formed a hammer chart pattern whose lower side was at. This shows a hammering out of a base and reversal setup. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. Web a hammer candle is a popular pattern in chart technical analysis. Our guide includes expert trading tips and examples. And, what is an inverted hammer? Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. How to trade a hammer? Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. The formation of a hammer. Web the first important thing is that jasmy token formed a hammer chart pattern whose lower side was at $0.0193. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Web 11 chart patterns you should know. This could mean that the bulls have been able to counteract the bears to help the stock find support. Learn to identify trend reversals with candlestick in 2 hours by market experts. The green candles post the hammer formation denote confirmation of price reversal to the upside.Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer pattern candlestick chart pattern. Bullish Candlestick chart

What is a Hammer Candlestick Chart Pattern? LiteFinance

What is a Hammer Candlestick Chart Pattern? LiteFinance

Inverted Hammer Candlestick Pattern Quick Trading Guide

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Tutorial on Hammer Candlestick Pattern

Hammer Chart Pattern

What is Hammer Candlestick Pattern June 2024

It Manifests As A Single Candlestick Pattern Appearing At The Bottom Of A Downtrend And.

The Information Below Will Help You Identify This Pattern On The Charts And Predict Further Price Dynamics.

This Article Illustrates These Patterns In This Order:

Web In This Guide To Understanding The Hammer Candlestick Formation, We’ll Show You What This Chart Looks Like, Explain Its Components, Teach You How To Interpret It With An Example, And Discuss How To Trade On A Hammer.

Related Post: