Reversal Flag Pattern

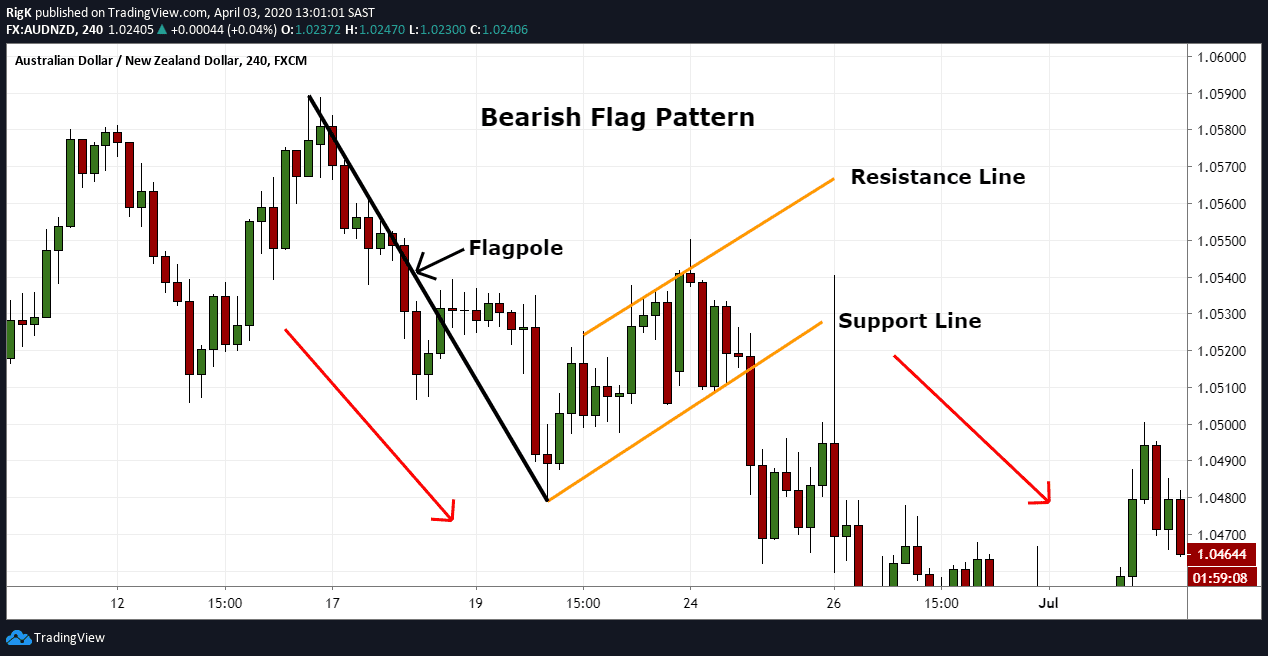

Reversal Flag Pattern - Web a reversal is a trend change in the price of an asset. A crucial criterion to keep in mind when choosing trend reversal indicator or indicators in general. Reversal chart patterns can also be trend continuation patterns—the context is what. Web this week's action provided confirmation, and both the monthly and weekly charts have made potential reversal patterns. An uptrend is created by higher swing highs and higher swing. Learn how to trade bull flag and bear flag chart patterns the right way. Web reversal chart patterns. Web there are three potential price target levels indicated by 1.27, 1.414 and 1.618 fib extensions, which each double as a potential price reversal zone (prz). The trend pauses for a while and then heads in the opposite direction. Share the reversal chart patterns cheat sheet pdf for. Some common reversal chart patterns are the inverse head and shoulders, ascending triangle, and double bottom; One of the most popular reversal patterns in forex trading is the head and shoulders pattern. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Flag patterns signify trend reversals after a period of consolidation. A crucial criterion to keep in mind when choosing trend reversal indicator or indicators in general. Web all reversal chart patterns like the hammer, hanging man, and morning/evening star formations. Final flag reversals are common because every reversal follows some kind of flag and therefore is a type of final flag reversal. Share the reversal chart patterns cheat sheet pdf for. Web a reversal is a trend change in the price of an asset. Reversal chart patterns can also be trend continuation patterns—the context is what. A crucial criterion to keep in mind when choosing trend reversal indicator or indicators in general. Some common reversal chart patterns are the inverse head and shoulders, ascending triangle, and double bottom; Flag patterns signify trend reversals after a period of consolidation. What do reversal patterns indicate? Web all reversal chart patterns like the hammer, hanging man, and morning/evening star. For example, suppose you have a bullish trend and the price action creates a trend reversal chart pattern, there is a big chance that the. These patterns identify that either bulls or bears are losing the battle. Web a distribution pattern is a reversal that occurs at market tops, where the instrument that is being traded becomes more eagerly sold. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web a distribution pattern is a reversal that occurs at market tops, where the instrument that is being traded becomes more eagerly sold than bought. Use volume confirmation for better sense of breakout. How does one trade continuation patterns?. These patterns signify periods where the bulls or the bears have run out of steam. Learn how to trade bull flag and bear flag chart patterns the right way. For example, suppose you have a bullish trend and the price action creates a trend reversal chart pattern, there is a big chance that the. Web nowadays, biden is an enthusiastic. Reversal chart patterns can also be trend continuation patterns—the context is what. One of the most popular reversal patterns in forex trading is the head and shoulders pattern. Web the break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals. Learn how to trade bull flag and bear flag. What are the types of reversal patterns? Web nowadays, biden is an enthusiastic advocate of additional gun control, including universal background checks for gun buyers, a crackdown on homemade firearms, red flag laws, and a federal. Web a reversal is a trend change in the price of an asset. Web the reversal patterns describe the change in trend by moving. An uptrend is created by higher swing highs and higher swing. Web common continuation patterns include triangles, flags, pennants, and rectangles. The trend pauses for a while and then heads in the opposite direction. Web the break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals. These patterns signify. Web nowadays, biden is an enthusiastic advocate of additional gun control, including universal background checks for gun buyers, a crackdown on homemade firearms, red flag laws, and a federal. Web reversal chart patterns. What do reversal patterns indicate? Web a price pattern that signals a change in the prevailing trend is known as a reversal pattern. Web the reversal patterns. How does one trade continuation patterns? This pattern consists of three peaks, with the middle peak being the highest. An uptrend is created by higher swing highs and higher swing. On the other hand, reversal patterns are opposite to continuation patterns. Since traders are entering before the new trend is clear, the probability of even the best looking setup is. They usually reverse the current price trend, causing a fresh move in the opposite direction. Web a price pattern that signals a change in the prevailing trend is known as a reversal pattern. This pattern consists of three peaks, with the middle peak being the highest. Once a trend ends, traders can look at the chart and see the final. Traders can use a variety of signals in combination with a flag pattern to help confirm its validity and improve the chances of a successful trade. Since traders are entering before the new trend is clear, the probability of even the best looking setup is usually only 40%. An uptrend is created by higher swing highs and higher swing. Continuation patterns organize the price action a trader is observing in a way that allows them to execute a. One of the most popular reversal patterns in forex trading is the head and shoulders pattern. The market exhibits a bilateral pattern when buyers and. These points pretty much sum up everything shown in this article. What you will learn here. Web discover the top 12 trend reversal patterns to enhance your trading skills and market analysis. Final flag reversals are common because every reversal follows some kind of flag and therefore is a type of final flag reversal. Here is an overview of each of these types and some examples. What do reversal patterns indicate? These patterns signify periods where the bulls or the bears have run out of steam. Some common reversal chart patterns are the inverse head and shoulders, ascending triangle, and double bottom; Web a reversal is a trend change in the price of an asset. The trend pauses for a while and then heads in the opposite direction.Flag Pattern Full Trading Guide with Examples

Bullish flag pattern reversal in SUNPHARMA YouTube

Bullish Wealth 🇮🇳 on Instagram "📈📉 Ultimate Chart Pattern Cheat Sheet

Gold Reversal + Bearish Flag Pattern Contiuation for FX_IDCXAUUSD by

NZDJPY Trend Reversal With A Flag Pattern for FXNZDJPY by FXTurkey

Flag Pattern Forex Trading

How To Trade Blog What Is Flag Pattern? How To Verify And Trade It

Reverse flag pattern for now! for BITSTAMPBTCUSD by WoodLandSprite

How to Trade Bear Flag Pattern Bearish Flag Chart Pattern

EURGBP REVERSE FLAG PATTERN for FXEURGBP by MbaliAcademy — TradingView

On The Other Hand, Reversal Patterns Are Opposite To Continuation Patterns.

What Are The Types Of Reversal Patterns?

Web A Flag Pattern Is A Technical Analysis Chart Pattern That Can Be Observed In The Price Charts Of Financial Assets, Such As Stocks, Currencies, Or Commodities.

Every Trend Comes To An End To Make Way For New Ones.

Related Post: